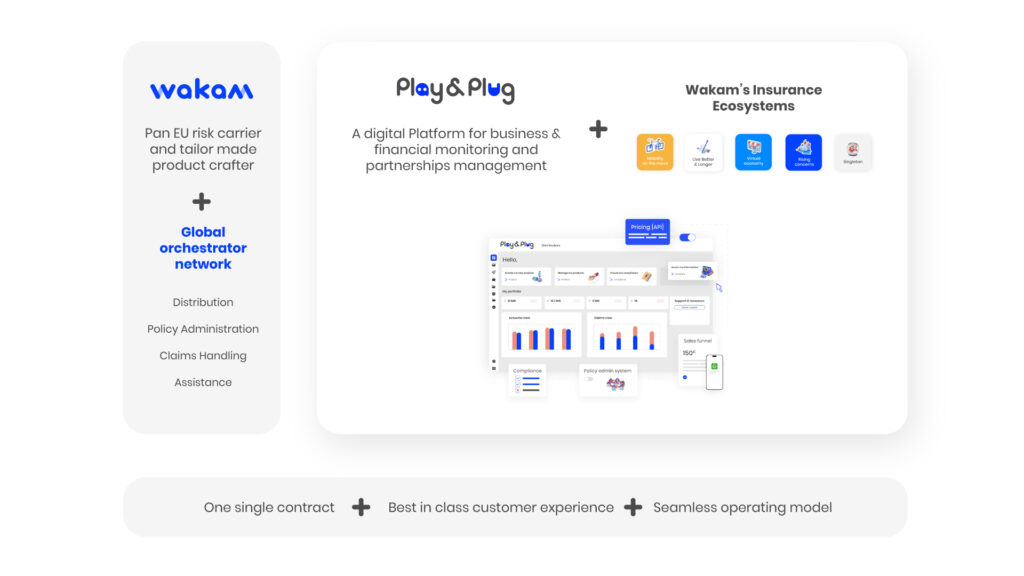

Insurance is not your core business?

Embedded insurance seamlessly fits protection into the purchasing journey.

20% of all global insurance sales could come from embedded offerings in the next 10 years. It’s a great opportunity for non-insurance companies to improve customer loyalty and generate additional revenue.